Tax Information

NO TAX RATE IMPACT

If voters approve the $550,000,000 bond package, there will be NO tax rate increase.

How can the school district propose a bond without increasing my tax rate?

Q:

Community Growth

A:

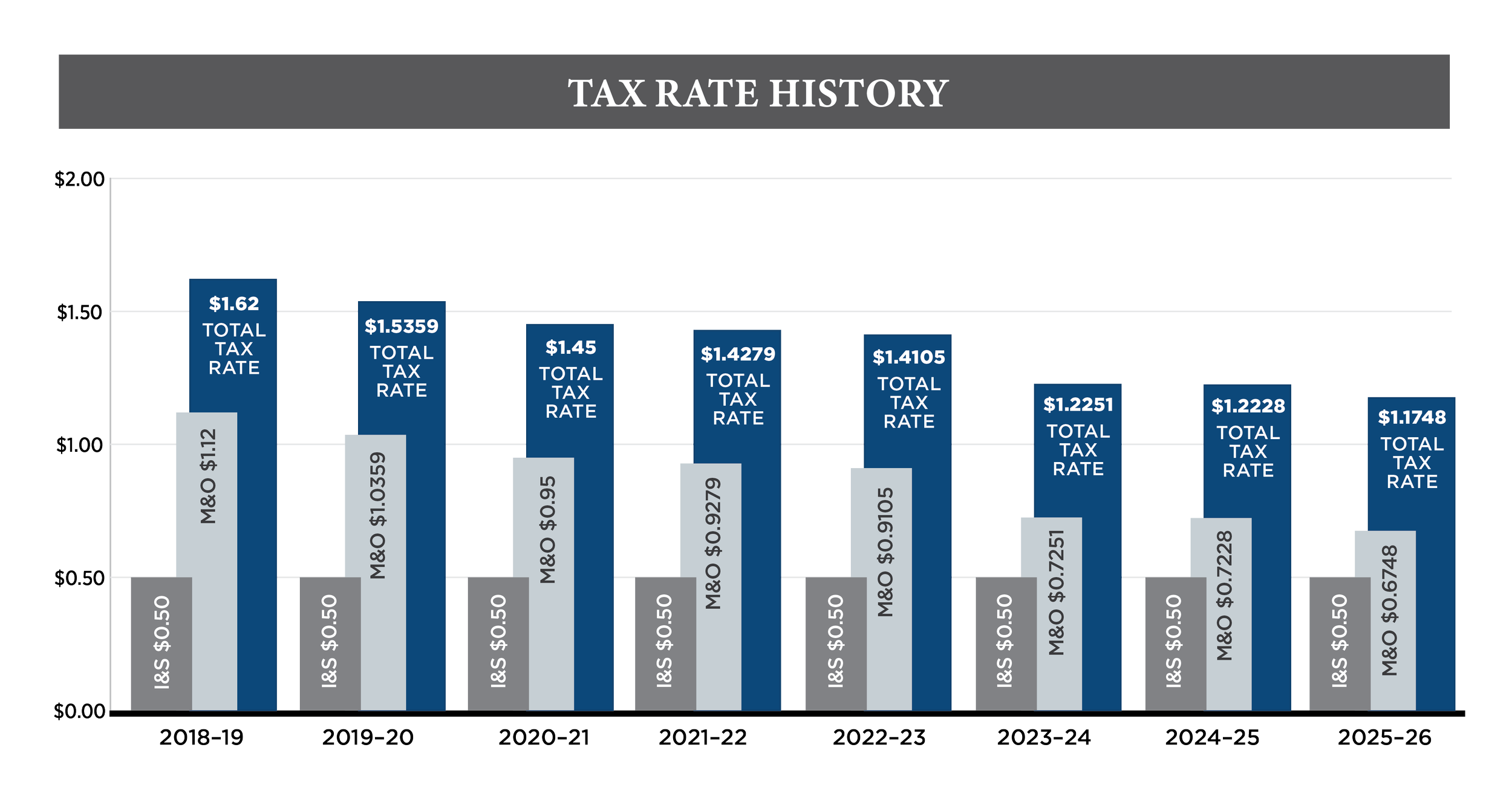

The district is able to propose this bond without increasing the tax rate because of significant community growth. As more homes and businesses are built, the overall tax base in the district increases.

This growth means that even with the same tax rate, the district collects more total revenue. That additional revenue allows the district to issue new bonds and fund projects without raising the current Interest & Sinking (I&S) tax rate.

In other words, growth is helping pay for growth—and the district can invest in new facilities while keeping the tax rate stable.

If there will be no I&S rate increase, why will my ballot read “THIS IS A PROPERTY TAX INCREASE?”

This language is required by state law to appear on all school bond ballots, even when the bond will not raise the tax rate. The intent is to make clear that approving a bond authorizes the district to continue collecting taxes for debt repayment (Interest & Sinking, or I&S) over an extended period.

In this bond election, there will be no increase to the I&S tax rate. The current rate of $0.50 per $100 of property valuation will remain the same. The bond allows the district to issue new debt while keeping the tax rate at its existing level for a longer time.

New valuations in appraisals and growth within the district help offset the cost of new bonds without requiring a tax rate increase.

*The school district does not determine your property’s value- these are determined by the Grayson County Appraisal District.